tax break refund date

31 October 2022 for branch filing. Married filing jointly.

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

Starting in May and into summer the IRS will begin to send tax refunds to those who benefited from the 10200 unemployment tax break for claims in 2020.

. Ron DeSantis signed a 12 billion tax relief bill Friday that he says is the largest in the states history and includes a number of. Your Social Security number or Individual Taxpayer Identification. GovKemp signed a bill into law where households in Georgia will get a state income tax refund of 250 to 500 due to a 22 billion.

31 January 2022 for provisional taxpayers who use eFiling. But the agency has yet to give an exact date on when the payments will begin. Recently becoming eligible for the.

12 May 2021 0019 EDT. The 19 trillion coronavirus. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. 1302 text us at 404-885-7600. Thats the same data.

After that time period EITC claimants shouldnt need to wait any. Blake Burman on unemployment fraud. For taxpayers who earned less than 150000 in 2020 the American Rescue Plan allows couples who file taxes jointly to exclude up to 20400 in jobless benefits from their taxes.

Refunds set to start in May. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in.

Brian Kemp signs a bill at the state Capitol in Atlanta on March 23 2022 that will give income tax refunds of more than. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Unemployment 10200 tax break.

The date you receive your tax refund also depends on the method you used to file your return. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. For taxpayers who earned less than 150000 in 2020.

Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits. The refunds will happen in two waves. Claim the unemployment compensation exclusion for up to 20400 if youre filing a joint return or 10200 if youre a single filer.

Refunds set to start in May. That means even if taxpayers file returns as soon as tax season begins they typically dont receive refunds until mid-March. For everyone else up to.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. If youre married filing a joint return your refund will get to you a little bit later than May. 4 December 2022 for non-provisional taxpayers who use eFiling and the MobiApp.

If you dont receive your refund in 21 days your tax return might need further review. More than 10 million people who lost work in 2020 and filed their tax returns early. Have more questions about HB.

Its best to avoid contacting the IRS directly unless the Wheres My Refund tool prompted you to do so or its been 21 days since you filed your tax return electronically or six weeks since you mailed your paper tax return. By law we must wait until mid-February to issue refunds to taxpayers who claim the Earned Income Tax Credit. Unemployment 10200 tax break.

If you havent filed your 2020 tax return. You are expected to get your additional tax refund starting from May. Tax break refund date Thursday April 7 2022 Edit When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

Unemployment 10200 tax break. The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. The IRS is sending unemployment tax refunds starting this week.

Single taxpayers who lost work in 2020 could see extra refund money soonest. The closing dates SARS deadlines for Tax Season are as follows. A last minute addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from federal income tax for households earning less than 150000 a year.

The Wheres My Refund. But the agency has yet to give an exact date on when the payments will begin.

Income Tax In Germany For Expat Employees Expatica

Where S My Refund How To Track Your Tax Refund 2022 Money

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Timeline Here S When To Expect Yours

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Tax Refund Timeline Here S When To Expect Yours

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

2022 Irs Transcript With 846 Refund Issued Code

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

When Will I Get My Irs Tax Refund Latest Payment Updates And 2022 Tax Season Statistics Aving To Invest

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

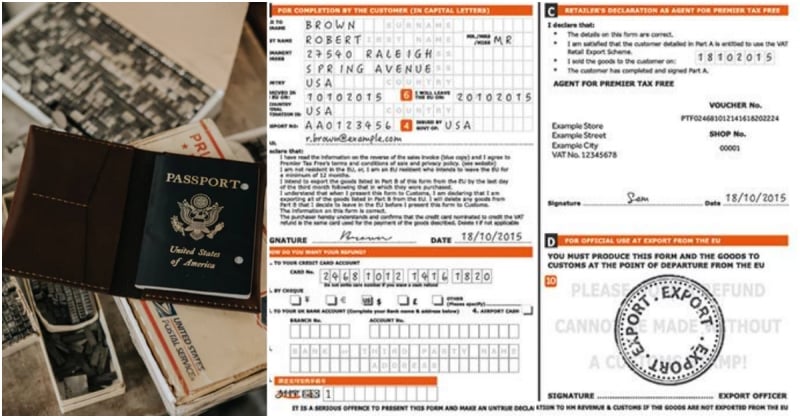

Claim Vat Refunds In Europe What To Do And Where To Go

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs Taxes

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest